modified business tax return instructions

Use our detailed instructions to fill out and eSign your documents online. Form 100W California Corporation Tax Return Booklet Waters Edge Filers.

Additionally the new threshold is decreased from 85000 to 50000 per quarter.

. Attach Form 8960 to your return if your modified adjusted gross income MAGI is greater than the applicable threshold amount. At enrollment the Marketplace may have referred to APTC as your subsidy or tax credit or advance payment. If the credit amount is higher than the MBT tax owed it may be carried forward up to the fourth quarter immediately.

Total gross wages are the total amount of all gross wages and reported tips paid for a calendar quarter. Attach the original Form 3115 to your federal income tax return for the year of the change including extensions. Individual Tax Return Form 1040 Instructions.

File an amended return on Form 1120s by sending the return along with any schedules that changed to the address where the original S corporation tax return was filed. File Form 3115 in duplicate for an automatic change request. If the sum of all wages for the 915 quarter.

SB 483 of the 2015 Legislative Session became effective July 1 2015 and changes the tax rate to 1475 from 117. Forget about scanning and printing out forms. Enter the amount from line 3 here and on Form 4562 line 1.

Gross wages payments made and individual employee information. If the change in your S corporation taxes results in a change to shareholder information you must also file an amended Schedule K. Individual Tax Return Form 1040 Instructions.

INSTRUCTIONS - MODIFIED BUSINESS TAX RETURN - GENERAL BUSINESSES ONLY Financial Institutions need to use the form developed specifically for them TXR-02104 IF YOU COMPLETE THIS FORM ONLINE THE CALCULATIONS WILL BE MADE FOR YOU. Instructions for Form 1040. The modified business tax covers total gross wages less employee health care benefits paid by the employer.

BUSINESS TAX MINING RETURN This form is a universal form that will calculate tax interest and penalty for the appropriate periods if used on-line. AB 80 which chaptered on April 29 2021 provides modified conformity to the. Quick guide on how to complete nevada modified business tax return form.

If APTC was paid on your behalf or if APTC was not paid on your behalf but you wish to take the PTC you must file Form 8962 and attach it to your tax return Form 1040 1040-SR or 1040-NR. Modified Adjusted Gross Income MAGI. However the first 50000 of gross wages is not taxable.

Instructions for Form 1040 Form W-9. Issued under authority of Public Act 36 of 2007. Exceptions to this are employers of exempt organizations and employers with household employees only.

Modified Adjusted Gross Income MAGI in the simplest terms is your Adjusted Gross Income AGI plus a few items like exempt or excluded income and certain deductions. Return is for calendar year 2019 or for tax year beginning. INSTRUCTIONS - MODIFIED BUSINESS TAX RETURN - GENERAL BUSINESSES ONLY Financial Institutions need to use the form developed specifically for them TXR-02105 IF YOU COMPLETE THIS FORM ONLINE THE CALCULATIONS WILL BE MADE FOR YOU.

MAGI can vary depending on the tax benefit. Federal Employer Identification Number FEIN or TR Number Doing Business As DBA 8. To amend a tax return for an S corporation create a copy of the original return on Form 1120-S and check Box H 4 Amended Return on the copy.

When and Where to File Form 3115. The Nevada Modified Business Return is an easy form to complete. INSTRUCTIONS - MODIFIED BUSINESS TAX RETURN - GENERAL BUSINESSES ONLY - Use this form only for the quarterly filing period beginning July 1 2009 Financial Institutions need to use the form developed specifically for them TXR-02101 Line 1.

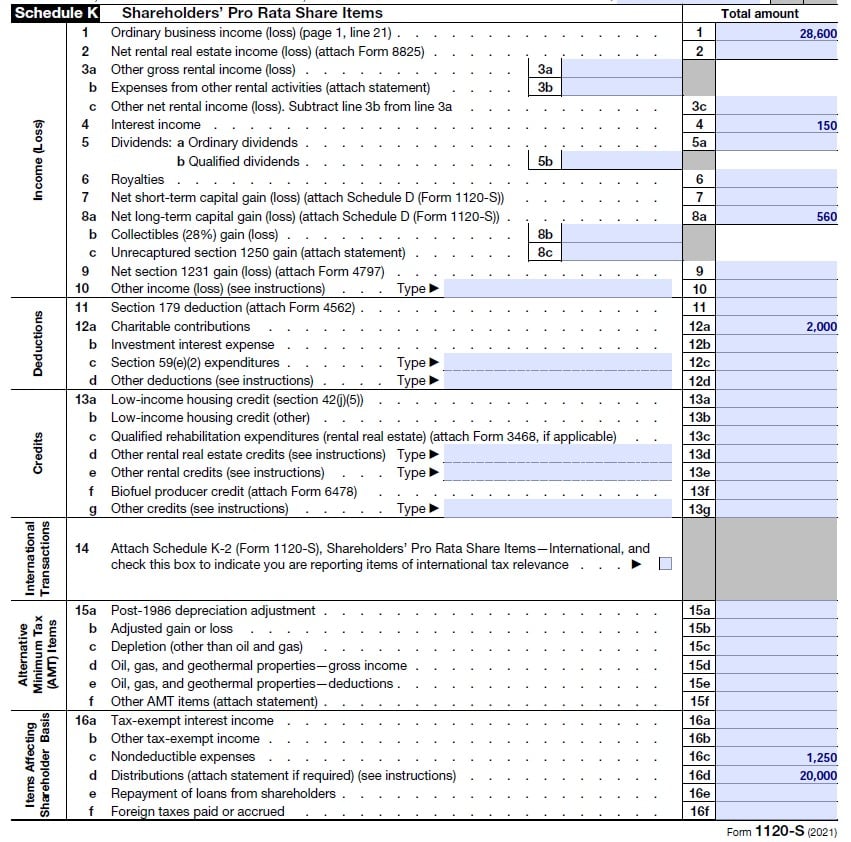

Existing instructions modified to the Schedule K and Schedule K-1 100S. It requires data and information you should have on-hand. 2019 MICHIGAN Business Tax Annual Return.

Taxable wages x 2 02 the tax due. Total Gross Wages - Enter the total amount of all gross wages and reported tips paid this calendar quarter. Commerce Tax Credit - Enter 50 of the Commerce Tax paid in the prior tax year up to the amount of MBT tax owed.

Taxpayer Name print or type 7. Total Gross Wages - Enter the total amount of all gross wages and reported tips paid this calendar. Child tax cedit or the cr edit for other dependents such as the r foreign tax cedit education cr edits or general business cr editr Owe other taxes such as self-employment tax household employment taxes additional tax on IRAs or other quali ed retiement plans and tax-favor ed accountsr.

Page 3 Column 2 Whats NewTax Law Changes First through Fourth Paragraph positions. You can request approval for a change in accounting methods in one of two ways. BUSINESS TAX GENERAL BUSINESS.

The maximum section 179 deduction limitation for 2021. When to file an amended tax return. Schedule 1 Part I Schedule 1 Part II Schedule 2.

This is the standard quarterly return for reporting the Modified Business Tax for General Businesses. General Business The tax rate for most General Business employers as opposed to Financial Institutions is 1378 on wages after deduction of health benefits paid by the employer and certain wages paid to qualified veterans. If the sum of all taxable wages after health.

Other rental income or loss from a section 162 trade or business reported on Schedule K. What is the Modified Business Tax. Enter the smaller of line 1 or line 2 here.

Enter the amount from line 1 here and on Form 4562 line 2. Maximum threshold cost of section 179 property before reduction in limitation calculation. The IRS uses your MAGI to determine your eligibility for certain deductions credits and retirement plans.

SignNows web-based program is specifically designed to simplify the management of workflow and enhance the entire process of proficient document. This article includes step-by-step instructions for when and how to amend your tax return using Form 1040-X. BUSINESS TAX MINING RETURN This form is a universal form that will calculate tax interest and penalty for the appropriate periods if used on-line.

Then use the copy to make the changes to the return and re-file. Needed to file the estate or trust return use Form 7004 Application for Automatic Extension of Time To File Certain Business Income Tax Information and Other Returns to apply for an automatic 5½-month extension of time to file. You can find the appropriate address on Page 3 of the instructions for Form 1120s.

Do not enter an amount less than zero. POPULAR FORMS. If you dont however have this information readily available this simple form can end up taking hours to complete.

A copy of Form 3115 must also be filed with the IRS. Use this as your opportunity to get. Total Gross Wages - Enter the total amount of all gross wages and reported tips paid this calendar quarter.

INSTRUCTIONS - MODIFIED BUSINESS TAX RETURN - FINANCIAL BUSINESSES ONLY General Businesses need to use the form developed specifically for them TXR-02005 Line 1. How to file an amended tax return. Modified Business Tax NRS 463370 Gaming License Fees.

Instructions For Form 8995 A 2021 Internal Revenue Service

Purchase Order Templates Word 34 Purchase Order Examples Pdf Doc Free Premium Templa Purchase Order Template Purchase Order Form Order Form Template

Publication 908 02 2022 Bankruptcy Tax Guide Internal Revenue Service

Business Continuity Planning For Government Cash And Debt Management In Technical Notes And Manuals Volume 2021 Issue 010 2021

Form 4562 A Simple Guide To The Irs Depreciation Form Bench Accounting

Publication 908 02 2022 Bankruptcy Tax Guide Internal Revenue Service

Tax Time 10 Most Common Irs Forms Explained

3 11 16 Corporate Income Tax Returns Internal Revenue Service

How To Complete Form 1120s Schedule K 1 With Sample

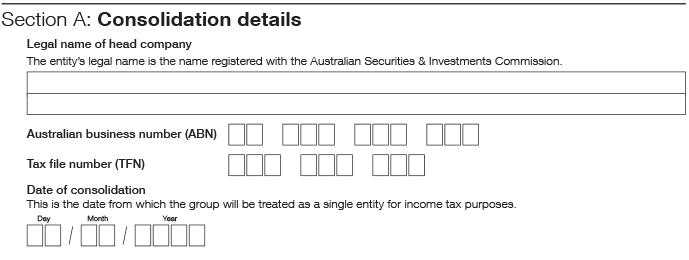

Notification Forms And Instructions Australian Taxation Office

Publication 908 02 2022 Bankruptcy Tax Guide Internal Revenue Service

/trump-s-tax-plan-how-it-affects-you-4113968-6d78115126514c15a71278d826a751ed.gif)